Admissions

TYPES OF FINANCIAL AID AVAILABLE

FEDERAL PELL GRANTS are monies given to eligible students to help pay for school related expenses and awarded based on financial need.

Eligibility Requirements

- Meet the basic eligibility criteria to receive federal aid

- In good standing with Satisfactory Academic Progress Standards for financial aid

- Must have a qualifying EFC as determined by the FAFSA

- Must not have a bachelor’s graduate, or professional degree

- Must not exceed the 600% Pell Lifetime Eligibility Used (LEU) Limit

Scheduled Award Amount

Each year the U.S. Department of Education publishes a Pell table used to determine Pell Grant awards.

The amount you receive will depend on:

- Your EFC

- Your enrollment status

STUDENT LOANS

A loan is a legal obligation that you will be responsible for repaying with interest. If you plan to take out a student loan, we encourage you to be a responsible borrower by following these tips:

- Only borrow what you need

- Keep track of how much you are borrowing

- Research starting salaries in your field

- Understand the terms of your loan and keep copies of your master promissory note

- Make payments on time

- Stay connected with your loan servicer

Federal Direct Student Loans

The Department of Education (ED) is your lender for all Federal Direct Student Loans. These are low-interest loans that must be repaid at a future date, usually beginning six months after you graduate, leave school, or are no longer enrolled as a half-time student. For more information regarding repayment, please visit.

https://studentaid.gov/. ED charges an origination fee of the total amount borrowed per loan. This means the money you receive will be less than the amount you borrow. You're responsible for repaying the entire amount you borrowed plus any interest accrued, and not just the amount you received. The interest rate varies depending on the loan type and for most federal student loans, the first disbursement date.

Current interest rates are available for viewing at https://studentaid.gov/understand-aid/types/loans/interest-rates. Listed below are the different types of Direct Loans you may receive while attending Barber Institute of Texas:

- Direct Subsidized Loan

- Direct Unsubsidized Loan

Before borrowing a federal student loan, you must complete entrance counseling to ensure you understand the responsibilities and obligations you are assuming. You may complete this counseling at https://studentaid.gov/.

In addition to entrance counseling, you are also required to sign a Master Promissory Note (MPN). This is a legal document in which you promise to repay your loan(s) and any accrued interest and fees to the U.S. Department of Education. It also explains the terms and conditions of your loan(s). You must complete the entrance counseling and sign the MPN before you receive a loan payment.

If you receive a federal student loan payment, you will be required to complete exit counseling once you graduate or stop attending. Exit Counseling provides vital information to prepare you to repay your federal student loan(s).

DIRECT STUDENT LOANS are borrowed monies through the U.S Department of Education that must be repaid (with interest)

DIRECT SUBSIDIZED LOANS are awarded to student who show financial need and don’t accrue interest while the student is in school. You have a six-month grace period after you graduate, withdraw or drop below half-time.

DIRECT UNSUBSIDIZED LOANS are available to all student, regardless of financial need. Interest does accrue on this loan while the student is in school. The student has a six-month grace period of repayment after graduation, withdrawal or dropping below half-time.

SCHOLARSHIPS are provided by some companies, professional associations, and religious groups to individuals or their family members seeking assistance paying for their education. Searching the internet is a great way to see what might be available to you.

HOW TO APPLY FOR AID

Complete and submit the Free Application for Federal Student Aid (FAFSA) by applying online at https://studentaid.gov/. You will have to complete the FAFSA every academic year using your tax information for the tax year requested on the application. You will complete a new FAFSA the first year and a renewal FAFSA in subsequent years.

You and one of your parents should create a FSA User ID, which consist of a username and password. The FSA User ID is used to authenticate the identity of students, parents, and borrowers, to access their federal student aid information.

Make sure that Barber Institute of Texas receives the information by selecting Barber Institute of Texas when you complete the FAFSA. Our school code is 042290. Upon their receipt of your information, you will receive an acknowledgement from the U.S. Department of Education

Barber Institute of Texas Verification Guide for Students

Award Year: 2022-2023

What is Verification?

When completing the FAFSA, students may be selected for a process called “Verification”. This process requires BIT to collect documents to verify certain information listed on the FAFSA is correct and make any required corrections to inaccurate information. Institutions that participate in Federal Title IV aid programs are required to perform verification on selected students.

Selection Process

Usually, the Central Processing System (CPS) selects which applications are to be verified, however, the school also has the authority to verify additional students. If selected for verification by CPS or the school, you are required to submit the documentation requested to complete the verification process.

- CPS Selection: The CPS sets a Verification Flag on the student’s processed FAFSA report to indicate that the student’s record has been selected for verification. The processed FAFSA is also known as the Student Aid Report (SAR).

- Update or Correction Selection: An update or correction your FAFSA may trigger the CPS to select the application or additional data elements for verification. In this case, the University must require you to submit any additional documentation needed to complete the verification process.

- Institutional Selection: The Institute has the authority and responsibility to select an application for verification if there is reason to believe that an applicant’s FAFSA information is inaccurate and/or contains conflicting information. If selected, you will be required to submit documentation to confirm the accuracy of the FAFSA data and/or to resolve the conflicting information and/or to verify specific data elements deemed necessary.

Federal regulations stipulate that the Institute need not verify an applicant's FAFSA information if:

- the applicant dies.

- the applicant does not receive assistance under the title IV, HEA programs for reasons other than failure to verify FAFSA information;

- the applicant is eligible to receive only unsubsidized student financial assistance (the student the institution is still required to verify the identity/statement of educational purpose); or

- the applicant who transfers to the institution, had previously completed verification at the institution from which he or she transferred and applies for assistance based on the same. FAFSA information used at the previous institution, if the current institution obtains a letter from the previous institution-

(1) stating that it has verified the applicant's information; and

(2) providing the transaction number of the applicable valid ISIR.

Further, unless the Institute has reason to believe that the information reported by a dependent student is incorrect, it need not verify the applicant's parents' FAFSA information if:

- the parents are residing in a country other than the United States and cannot be contacted by normal means of communication.

- the parents cannot be located because their contact information is unknown and cannot obtained by the applicant; or

- both applicant’s parents are mentally incapacitated.

- both parents or the custodial parent has died

Lastly, unless the institution has reason to believe that the information reported by an independent student is incorrect, it need not verify the applicant's spouse's information if:

- the spouse is deceased.

- the spouse is mentally incapacitated.

- the spouse is residing in a country other than the United States and cannot be contacted by normal means of communication; or

- the spouse cannot be located because his or her contact information is unknown and cannot be obtained by the applicant.

Notification

If your FAFSA is selected for verification by the Central Processing System (CPS), you will be notified of your status as follows:

- CPS will notify you on the Student Aid Report (SAR). Next to the EFC will be an asterisk. Referring to a comment in the student section of the SAR that tells you that you will be asked. by the school to provide documentation for verification; and

- BIT will send an email to you, notifying you that you have outstanding requirements that need to be submitted to complete your financial aid file.

Number in the Household and Number in College

Number in Household: When completing verification, who to include in the household is determined by your dependency status. The following persons may be listed in the household:

• If you are an independent student, per federal student aid rules, include the following in the household.

- Yourself

- Your spouse, excluding a spouse not living in your household as a result of death, separation, or divorce.

- Your dependent children if they will receive more than half of your support from you or your spouse.

- Your unborn child, if the child will be born before or during the award year and you will provide more than half of the child’s support from the projected date of birth to the end of the award year. Documentation from a medical practitioner with the expected delivery date may be required if the University has reason to believe this information is not valid.

- Other persons, if they live with you and receive more than half of their support from the student at the time of application and will continue to receive support for the entire award year.

• If you are considered a dependent student, per federal student aid, list the following persons living in your parent’s household.

- Yourself, even if you do not live with your parent.

- Your parent(s), excluding a parent not living in the household as a result of death, separation, or divorce.

- Your sibling(s), if they will receive more than half of their support from your parent(s) or the sibling would also be considered a dependent for financial aid purposes.

- Your children if they will receive more than half of their support from your parent(s)

- Your parent’s unborn child and/or your unborn child if the child will be born before or during the award year and your parent(s) will provide more than half of the child’s support from the projected date of birth until the end of the award year. Documentation from a medical practitioner with the expected delivery date may be required if the Institute has reason to believe this information is not valid.

- Other persons, if they live with and receive more than half of their support from the student

- or parent(s) at the time of application and will continue to receive support for the entire award year.

Number in College: The number in college includes all those in the household (see above) who are attending a post- secondary educational institution for at least half-time in at least one term in the award year (July 1, 2022-June 30, 2023), except parents of dependent students.

SATISFACTORY ACADEMIC PROGRESS (SAP)

For Students Receiving Federal Aid

At the end of the attainment of 450 hours or(12.5 weeks) and 900 hours or (25 weeks), BIT will evaluate the Satisfactory Academic Progress (SAP) for students receiving federal student aid.

Eligibility for Financial Aid

To maintain eligibility for financial aid, you must meet the following minimum SAP standards at the time of evaluation:

Failure to maintain these standards will result in the suspension of your financial aid and the loss of your financial aid eligibility.

- GPA: Minimum Cumulative Grade Point Average

The cumulative GPA at BIT will be evaluated in determining if a student is meeting the GPA standards.

-All students must maintain a 75 percent or higher in theory and practical classwork.

2. Pace/Completion Rate

All students must maintain 75 percent attendance rate or 108 out of 144 hours monthly up to the 450-hour evaluation point.

3. Maximum Time Frame for Certificate Completion

All students who are eligible to receive financial assistance, can only receive it for a limited period of time while pursuing a certificate. The number of clock hours a student attempts cannot exceed 150% of the clock hours required for completion in the chosen program of study. The Class A Barber Certificate is scheduled to be completed with (36 hrs per week) at 28 weeks or 7 months. Given the 150% time frame students will be given 42 weeks or 10.5 months to complete the program and receive financial aid funding.

Financial Aid Warning

Warning letters will be sent to students at the 450-hour evaluation point for the following reasons.

Students whose GPA is less than 75 percent in theory and practical courses.

Students whose Attendance is less than 75 percent for the 12.5 weeks

During this warning period, students will still receive financial aid funding, however letters will be sent explaining the possibility of needed advising for the maintaining of funds.

Financial Aid Probation/Suspension

Students on Financial aid warning will be placed on financial aid probation, and sent probation letters at the 900-hour evaluation period resulting in the loss of their financial aid, if either of the following situations occurs:

- Failing to meet the 75 percent GPA standards at the 900-hour SAP evaluation period.

- Failing to meet the 75 percent Pace/Completion Rate standards at the 900-hour SAP evaluation period.

- Exceeding 150% of the hours required in the program before completing your degree.

You will be notified by email if your financial aid has been suspended and which standard was not maintained.

Re-Establishing Financial Aid Eligibility

If your financial aid has been suspended it is possible to re-establish your financial aid eligibility. To re-establish eligibility, you must:

A. Satisfy the SAP requirements of 75 percent gpa and 75 percent of attendance at your own expense.

-OR-

B. Have an approved appeal on file.

Appeal Process

If one of the following extenuating circumstances have prevented you from meeting the financial aid SAP standards, you may be eligible to appeal the suspension of your financial aid.

- Injury or illness to you (the student)

- Death of an immediate relative

- Other Extenuating Circumstances

If none of the above-mentioned items have prevented you from meeting SAP, you are ineligible to appeal your financial aid suspension. Your financial aid will remain suspended until you meet BIT’s SAP Standards.

A complete appeal consists of the following:

- Completing a SAP appeal form which includes:

- A typed statement detailing what specifically happened that prevented you from meeting the required SAP standard?

- What has changed that will allow you to make satisfactory progress at your next evaluation?

2. Documentation or evidence of your extenuating circumstances (i.e.: letter from physician, counselor, therapist, academic advisor, hospital documentation, etc.) .

RETURN OF TITLE IV FUNDS

Title IV (Federal Financial Aid) funds are awarded under the assumption you will attend school for the entire period for which the assistance was awarded. If withdrawn (officially or unofficially), for any reason including medical circumstances, you may no longer be eligible for the full amount of Title IV funds that you were originally scheduled to might become a debt to the school that you are responsible for paying.

You are considered to have withdrawn from the term if you do not complete all the hours in the term that you were scheduled to complete. If you are receiving federal grant or loan funds and you withdraw from the term after beginning attendance, BIT is required to perform an R2T4 calculation to determine the amount of aid you have earned. If the amount of federal aid disbursed to you is greater than the amount you have earned, the unearned funds must be returned to the Department of Education( ED). If the amount of federal funds disbursed to you is less than the amount you have earned and are eligible, you may be eligible for a post-withdrawal disbursement of the earned aid that was not received.

Federal grant and loan funds subject to the R2T4 calculation include:

- Federal Pell Grant

- Federal Direct Loans (Subsidized, Unsubsidized, Loans)

- If you withdraw prior to the Pell Recalculation Date (PRD), these grants will be cancelled, which may leave you with a balance owed to BIT.

Up through the 60% point in each payment period (Clock-hour term), a pro rata schedule is used to determine the amount of Title IV funds a student earns at the time of withdrawal. After the 60% point in the payment, a student has earned 100% of the Title IV funds the student was scheduled to receive during the period and no return of funds is required.

If you would like to withdraw from your courses, you should contact the Records Office at BIT or your academic advisor. Financial Aid recipients should also visit with a financial aid administrator to receive. counseling regarding the consequences of withdrawing (i.e., repayment obligations, impact on your satisfactory academic progress.

CODE OF CONDUCT

NASFAA’s Statement of Ethical Principles provides that the primary goal of the institutional financial aid professional is to help students achieve their educational potential by providing appropriate financial resources. To this end, this Statement provides that the financial aid professional shall: Be committed to removing financial barriers for those who wish to pursue postsecondary learning. Make every effort to assist students with financial need. Be aware of the issues affecting students and advocate their interests at the institutional, state, and federal levels. Support efforts to encourage students, as early as the elementary grades, to aspire to and plan for education beyond high school. Educate students and families through quality consumer information. Respect the dignity and protect the privacy of students, and ensure the confidentiality of student records and personal circumstances. Ensure equity by applying all need analysis formulas consistently across the institution’s full population of student financial aid applicants. Provide services that do not discriminate on the basis of race, gender, ethnicity, sexual orientation, religion, disability, age, or economic status. Recognize the need for professional development and continuing education opportunities. Promote the free expression of ideas and opinions, and foster respect for diverse viewpoints within the profession. Commit to the highest level of ethical behavior and refrain from conflict of interest or the perception thereof. Maintain the highest level of professionalism, reflecting a commitment to the goals of the National Association of Student Financial Aid Administrators. Task Force on Standards of Excellence Adopted by Board of Directors, April 1999 NASFAA’s Statement of Ethical Principles and Code of Conduct for Institutional Financial Aid Professionals The NASFAA Board of Directors recognizes that institutional financial aid professionals do not function in a vacuum. First and foremost, they accept an obligation to their institution, and especially its students and families, to manage and interpret the complexities of the student financial assistance process. They must also work collaboratively with state and federal agencies and with private entities such as student loan providers to promote college access and improve student service. Finally, every student financial aid professional must continually be involved in training and professional development to ensure that he or she can provide efficient service that is in strict compliance with all applicable laws and regulations. The NASFAA Board of Directors also recognizes that the institutions employing financial aid professionals increasingly are bound under federal and state law, or voluntarily adopted codes of institutional conduct, that bear on the administration of the student financial aid programs in general and the student loan programs in particular.

While financial aid professionals cannot dictate institutional conduct, they can – and must – abide by their own professional standards. Ensuring ethical behavior through established standards and guidance is the most important core principle for self-governance in any profession in order to assure the public of the profession’s integrity. This is a responsibility we embrace. In consideration of the complexity of the tasks confronting institutional financial aid professionals, the NASFAA Board of Directors has promulgated this Code of Conduct to provide further guidance respecting the Statement of Ethical Principles. The Code is intended to help guide financial aid professionals in carrying out these obligations, particularly about ensuring transparency in the administration of the student financial aid programs, and to avoid the harm that may arise from actual, potential, or perceived conflicts of interest. Code of Conduct for Institutional Financial Aid Professionals An institutional financial aid professional is expected to always maintain exemplary standards of professional conduct in all aspects of carrying out his or her responsibilities, specifically including all dealings with any entities involved in any manner in student financial aid, regardless of whether such entities are involved in a government sponsored, subsidized, or regulated activity. In doing so, a financial aid professional should: Refrain from taking any action for his or her personal benefit. Refrain from taking any action he or she believes is contrary to law, regulation, or the best interests of the students and parents he or she serves. Ensure that the information he or she provides is accurate, unbiased, and does not reflect any preference arising from actual or potential personal gain. Be objective in making decisions and advising his or her institution regarding relationships with any entity involved in any aspect of student financial aid. Refrain from soliciting or accepting anything of other than nominal value from any entity (other than an institution of higher education or a governmental entity such as the U.S. Department of Education) involved in the making, holding, consolidating or processing of any student loans, including anything of value (including reimbursement of expenses) for serving on an advisory body or as part of a training activity of or sponsored by any such entity. Disclose to his or her institution, in such manner as his or her institution may prescribe, any involvement with or interest in any entity involved in any aspect of student financial aid. Adopted by Board of Directors, May 2007 NASFAA’s Statement of Ethical Principles and Code of Conduct for Institutional Financial Aid Professionals Explanation of the Code of Conduct As previously noted, financial aid professionals work within vastly differing institutional environments and share decision-making authority regarding financial aid policy, practices, and procedures. NASFAA strongly encourages each financial aid professional to engage his or her institutional colleagues so that there is common understanding regarding the conduct of their respective obligations.

To facilitate this exchange, NASFAA has provided the following explanation of the elements of the Code of Conduct:

1. “Refrain from taking any action for his or her personal benefit.” While performing one’s work in an exemplary fashion should result in “personal benefit” in the form of professional advancement and recognition, this provision obviously relates to actions that are contrary to the obligations the individual has to the institution and its students and their parents. This includes the individual, or a member of their family, never accepting cash payments, stocks, club memberships, gifts, entertainment, expense-paid trips, or other forms of inappropriate remuneration from any business entity involved in any aspect of student financial aid. It also relates to actions which, while on balance may be supportive of the financial aid professional’s work, are chosen from among alternatives because they also benefit the financial aid professional.

2. “Refrain from taking any action he or she believes is contrary to law, regulation, or the best interests of the students and parents he or she serves.” The statement – never acting contrary to law or regulation – should be self-evident. However, note the use of the term “believes to be contrary to law [or] regulation.” The financial aid professional works in a complex legal environment. Any doubts as to whether a course of conduct is legally proper should be resolved by referring the matter to the institution’s legal advisors for guidance. In addition, the individual should understand and adhere to all institutional policies as well as other local, state or federal requirements that are applicable to his or her conduct or job performance.

3. “Ensure that the information he or she provides is accurate, unbiased, and does not reflect any preference arising from actual or potential personal gain.” When providing information, always the key should be transparency. Students and parents should be able to fully understand their rights, obligations, and – of paramount importance – their alternatives. Applying these principles to the use of “preferred lender” lists is instructive. If an institution elects to provide such a list, a financial aid professional is expected to demonstrate transparency, completeness, and accuracy of information by ensuring that: Students and their parents understand they are not required to use any of the lenders on a “preferred lender” list, are free to select the lender of their choice, and understand the process for selecting a lender and applying for a loan; The school will promptly certify any loan from any lender selected by a borrower; The process through which “preferred lenders” are selected is fully disclosed; Borrowers are provided with consumer information about the loan products offered by entities on a school’s “preferred lender” list. Such information must include the disclosure of competitive interest rates, terms, and conditions of federal loans; high quality loan servicing; or additional benefits beyond the standard terms and conditions for such loans. The process through which students execute Master Promissory Notes preserves a student’s right to select the lender of his or her choice; Lenders who are included in a “preferred lender” list disclose agreements to sell their loans to other entities; and The selection of lenders for inclusion on a “preferred lender” list is based solely on the best interests of the students and parents who may rely on such a list. NASFAA’s Statement of Ethical Principles and Code of Conduct for Institutional Financial Aid Professionals

4. “Be objective in making decisions and advising his or her institution regarding relationships with any entity involved in any aspect of student financial aid.” Financial aid professionals must always be fairhanded when recommending or entering a business relationship with any entity offering a product or service related to financial aid. A lender may not be placed on a school’s “preferred lender” list in exchange for a prohibited inducement. Placement on a “preferred lender” list, therefore, must not be based on benefits provided to the institution, an employee of the institution, or its students in connection with loans not covered by such list. In the same light, financial aid professionals should not arrange for alternative (i.e., non-federal or “opportunity”) loan programs that disadvantage students or parents who do not receive such loans. Transparency also requires that when a student or parent has communication with what he or she believes to be the institution’s financial aid office that is precisely what should occur; no employee or agent of a lender should ever be identified, either directly or by implication, as an employee or agent of the institution.

5. “Refrain from soliciting or accepting anything of other than nominal value from any entity (other than an institution of higher education or a governmental entity such as the U. S. Department of Education) involved in the making, holding, consolidating or processing of any student loans, including anything of value (including reimbursement of expenses) for serving on an advisory body or as part of a training activity of or sponsored by any such entity.” The first element in the Code of Conduct prohibits the conflict of interest that arises when one acts for personal gain. This fifth element is intended to avoid the appearance of conflict of interest that arises when a financial aid professional accepts benefits from a lending institution or similar entity. The fact that the financial aid professional may have no intention to provide an advantage to the lender as a result of the benefit he or she receives, and indeed does not provide any such advantage, is not the point. The benefit received by the financial aid professional creates an appearance that he or she may not be impartial and may not be acting solely in the best interests of the students and parents he or she serves. In our profession such an appearance can do great harm, and it must be strictly avoided. The term “nominal value” leaves some room for interpretation. This is intentional: many states and institutions have laws and policies that regulate such activities, and it is common for such laws and policies to define with specificity what is meant here by “nominal value.” As a general guide, and subject to more restrictive laws and policies, a total retail value of not more than $10 should be considered reasonable. The last component of this element of the Code deals with reimbursement for travel and expenses incurred when serving on lender advisory boards or attending lender-sponsored training activities. There is certainly value in providing lenders with the unique expertise and perspective that only financial aid professionals can provide, but receiving any remuneration for such service, even if only in the form of reimbursement for expenses, creates the appearance of conflict that must be avoided. The same principle applies to reimbursement for lender-sponsored training activities. Professional development is a key component of being an effective financial aid professional, and attending lender-sponsored training programs can be a valuable way of obtaining the most current information. Again, however, receiving any remuneration for such attendance from a source other than his or her institution, even in the form of reimbursement for expenses, creates the same impermissible appearance of conflict of interest, and must be avoided. NASFAA’s Statement of Ethical Principles and Code of Conduct for Institutional Financial Aid Professionals

6. “Disclose to his or her institution in such manner as his or her institution may prescribe any involvement with or interest in any entity involved in any aspect of student financial aid.” The same principle of transparency, or avoiding the appearance of conflict of interest, drives this element of the Code. Every institution has a written policy on disclosure of potential conflicts of interest, and a process of determining whether an employee’s involvement creates an actual conflict of interest or the appearance of a conflict. It is the obligation of the financial aid professional to strictly abide by the requirements of his or her institution’s conflict of interest policy, particularly about any activities, involvement, investment, or interest in any financial aid-related entity. Institutional conflict of interest policies typically describes the nature of investments that require disclosure and review, generally excluding interests held by mutual funds or below a certain minimum value. As a practical matter, financial aid professionals should avoid any investment in or financial relationships with lenders and similar entities. These principles should apply throughout the administration of the programs for which the financial aid professional is responsible, including Direct Loans, FFELP, and loans originated under the School as Lender program. There should never be any difference between “ethical” and “best” practices. The ethical practice is the best practice. As an organization, NASFAA unequivocally supports the principles and practices described in this Statement. When a practice or policy arises that appears in conflict with these principles, it is the obligation of the financial aid professional to bring this to the attention of those responsible within his or her institution, and to seek a resolution consistent with these principles. Questions regarding the principles and practices described in this statement should be directed to ethics@nasfaa.org. May 24, 2007, NASFAA’s Statement of Ethical Principles and Code of Conduct for Institutional Financial Aid Professional

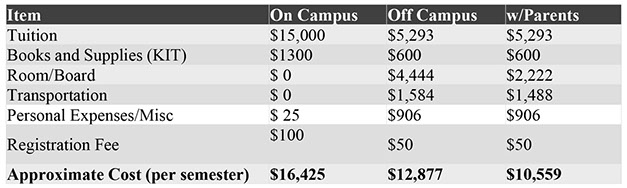

TUITION AND FEES---- FALL 2022 AND SPRING 2023

Estimated Cost of Attendance (1st Year)

Estimated Cost of Attendance ( Year 2)

Admissions

Enrollment is done by appointment or walk-ins from 8:30 a.m. to 5:00 p.m. on Tuesday of each week.

Admission Requirements

Barber Institute of Texas School is an equal educational opportunity institution. Qualified applicants are admitted based on the admission policies of the institution. The Barber Institute does not recruit students already attending or another school offering similar programs of study. The Barber Institute requires that each student enrolling in any course over 300 hours or greater offered by the school must present the following information:

Identification – current driver’s license or state issued photo identification.

Have a High School Diploma or transcripts showing graduation date.

Have a recognized equivalent of a High School Diploma such as a home schooled certificate by the state where the student resided during home school or a General Education Diploma (GED)

Home-Schooled, and obtained a secondary school completion credential for home school (this is based on the TDLR policies)

Are at least 18 years of age, (beyond the age of compulsory education in the state in which the institution is physically located).

Are not currently enrolled at a primary or secondary institution.

Programs are based on 36 clock hours a week.

Must provide a valid social security card.

If the individual seeking enrollment is a dependent minor, a parent or legal guardian must accompany the person on the visit and will be required to sign the enrollment contract/agreement.

Complete and sign an enrollment application form.

Pay an admission fee of $100.00 before student can start the program.

A $25.00 Enrollment fee payable to the Texas Department of Licensing & Regulation (TDLR) (money order/cash/credit card)

Provide 3 letters of recommendation (from a non-relative).

Note: All necessary paperwork must be turned in before you are able to enroll.

- Be able to speak, read, and write fluently in English (all classes are taught in English)

- Provide documentation of eligibility to work in the U.S.

Financial Aid is available to those who qualify.

High School Diploma Policy

The Barber Institute requires an official copy of a student's high school diploma for proof of receipt and validity. If there is any question about whether the school is considered to be a diploma mill school, the Admission Office will review and determine whether the diploma meets requirements. The Admission Office will use a list of accredited state agencies in order to determine a school's validity.

© 2023 Barber Institute of Texas. All Rights Reserved